Navigating the world of payroll taxes can be daunting, especially with all the forms and regulations that come into play. One essential form that often flies under the radar is IRS Form 8655. This little piece of paperwork has a big impact on how businesses manage their payroll tax responsibilities. Whether you’re a business owner looking to streamline your processes or an accountant searching for ways to simplify client reporting, understanding this form could save time and reduce headaches down the line. Let’s dive into what IRS Form 8655 is all about and explore its significance in managing payroll taxes effectively.

Who Needs to Fill Out and File Form 8655?

IRS Form 8655 is primarily designed for businesses that want to designate a third party to handle their payroll tax responsibilities. If your business employs workers and needs assistance with tax filings, this form is valuable.

Payroll service providers often use it to ensure they can act on behalf of clients when it comes to filing employment taxes. Whether you’re a small startup or a large corporation, if you’re looking to streamline your payroll processes, consider filling out Form 8655.

How to Fill Out and File IRS Form 8655

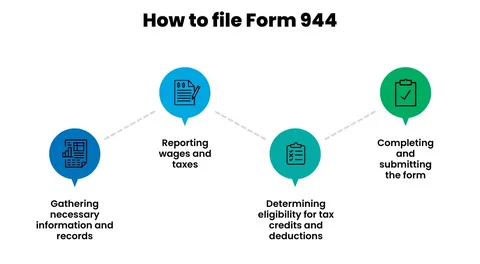

Filling out IRS Form 8655 is a straightforward process, but precision is essential. Begin by downloading the form from the IRS website.

Make sure to provide accurate information about your business and the tax matters you wish to delegate. You’ll need your Employer Identification Number (EIN) or Social Security Number if applicable.

Next, specify who will be handling payroll taxes on your behalf. This could be an accountant or a third-party service provider.

Benefits of Using IRS Form 8655 for Payroll Taxes

Utilizing IRS Form 8655 brings several advantages for businesses managing payroll taxes. This form allows employers to authorize a third party, such as an accountant or tax professional, to act on their behalf when it comes to filing and paying payroll taxes. By granting this authority, business owners can streamline their operations.

One significant benefit is the reduction of administrative burdens. Businesses often find themselves overwhelmed with paperwork and compliance requirements. With Form 8655 in place, you delegate these responsibilities effectively while ensuring that all necessary filings are completed accurately and on time.

Additionally, using IRS Form 8655 helps minimize the risk of errors. Tax professionals who regularly handle payroll matters are less likely to make mistakes than someone unfamiliar with the intricacies involved in payroll processing. This increased accuracy not only saves money but also protects your business from potential penalties associated with misfiling.

Another noteworthy advantage involves improved cash flow management. When a professional handles your payroll obligations, they can help schedule payments strategically ensuring funds are available when needed without straining your budget.